Axial Finance Premier

Analyse and follow on graphical charts the market trend

The easiness to use graphical charts and their quality of presentation allow to clearly and precisely analyse market trends in the short, medium and long term.

The graphical charts, which can be opened simultaneously with no number limit, provide

the ability to easily compare stocks together and to retain those which potential is more promising.

The identification of chart patterns and levels of support and resistance

on the time horizon studied show the times of the most profitable decisions.

The results of the graphical analysis is automatically registered in memory

and returned to the recall of each stock.

Many drawing tools are available to easily get the levels of Fibonacci, Gann,

Speed Line and Andrews forks.

Use the most relevant customizable technical indicators for your analysis

Technical indicators are the basis of technical analysis, they show and highlight the past and foreseeable market trends.

Axial Finance offers a wide range of customizable indicators (more than 60) that

can be very easily added into graphical charts, either in the upper part of the chart

(together with the price curve) or just below.

In the lower part of the chart, up to 5 indicators called "secondary indicators" can be

displayed simultaneously from a wide selection. A device called slideshow

allows to move vertically these indicators in a mouse clic.

For each indicator the style is customizable : color, thickness, dotted line and curve shape.

In addition, for some indicators like the Moving Average, the drawing can be

done with two colors, green or red depending if the curve is going up or down.

Get the detailed list of winner/loser stocks for all a market

Based on daily prices, the search of stocks among a market which, from a defined date, are the most winning or loosing or near their highest or lowest prices, is simple and fast to obtain.

The search can also be performed on a list of stocks created by the user and mixing stocks of different exchanges. Such lists have no limit in the number of stocks.

The overall result is displayed in a detailed table showing the percentage change since the start date and also with respect to the historical highest and lowest prices.

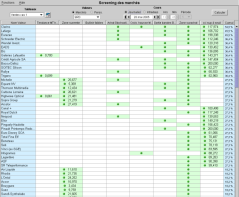

Automatically screen and get all stocks complying with your decision criterias

From a list of hundreds or thousands of stocks, the search of those stocks that meet simple or complex decision criterias is a very important possibility for a trader.

Axial Finance offers an easy solution to get quickly the expected result.

Simply select :

- The decision rules to apply from those of the software library. This library contains many rules that come with the software in which users can add their own rules

- A list of stocks of a market or a list of stocks created by the user

- The date of the research. This research can be conducted at a date in the past allowing to test and validate the rules applied

The search result is immediately obtained, typically a few seconds for a list of several thousand stocks.

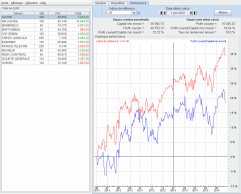

Manage and follow the performance of your portfolios

Axial Finance manages any number of portfolios including stocks or other instruments,

and instantly displays their current value, the potential and realized profits, the available cash.

The positions of a portfolio can be recorded in a specific currency (eg USD),

and the profit automatically calculated in the reference currency chosen (eg EUR)

with the current exchange rate.

Each open position shows the detailed status : number of shares, current value, average cost, unrealized and realized profits.

The orders book can trace the entire history of executed orders and in particular shows the total sales and profits realized over a chosen period.

The performance is calculated since the creation of the portfolio or an interim date. The relevant performance graph shows the evolution of the invested money in percentage and compares this evolution to that of a market index.

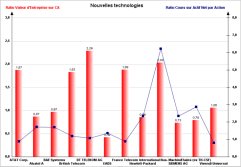

Improve the technical analysis with the fundamental analysis

Fundamental analysis is a very useful complement to the technical analysis for investors

over the medium and long term.

Data of companies for fundamental analysis are available on the Internet and entered

and stored in Axial Finance, then exploited in several ways:

- For each company over several years to analyze the evolution of the operating account.

- For the calculation of key financial ratios.

- For comparison of all companies in relation to their financial ratios.

- To search among companies in the same economic sector, those with the best prospects for profitability.

- To create dedicated indicators to fundamental analysis which can be combined with the indicators of technical analysis to provide a global analysis.